PropNex Picks

|October 07,2025SG Property & Travelling: Why Owning Here Opens Doors Abroad

Share this article:

Singaporeans love to travel. Whether it's a weekend getaway in Bangkok, a month-long road trip across Europe, or even a year abroad for work or lifestyle, the desire to explore runs deep. But behind that freedom lies something less glamorous yet essential: financial security.

Property ownership provides that stability. It's not just about having a roof over your head; it's about having the confidence to spend on experiences, take risks, and pursue passions - because you know your foundation is safe.

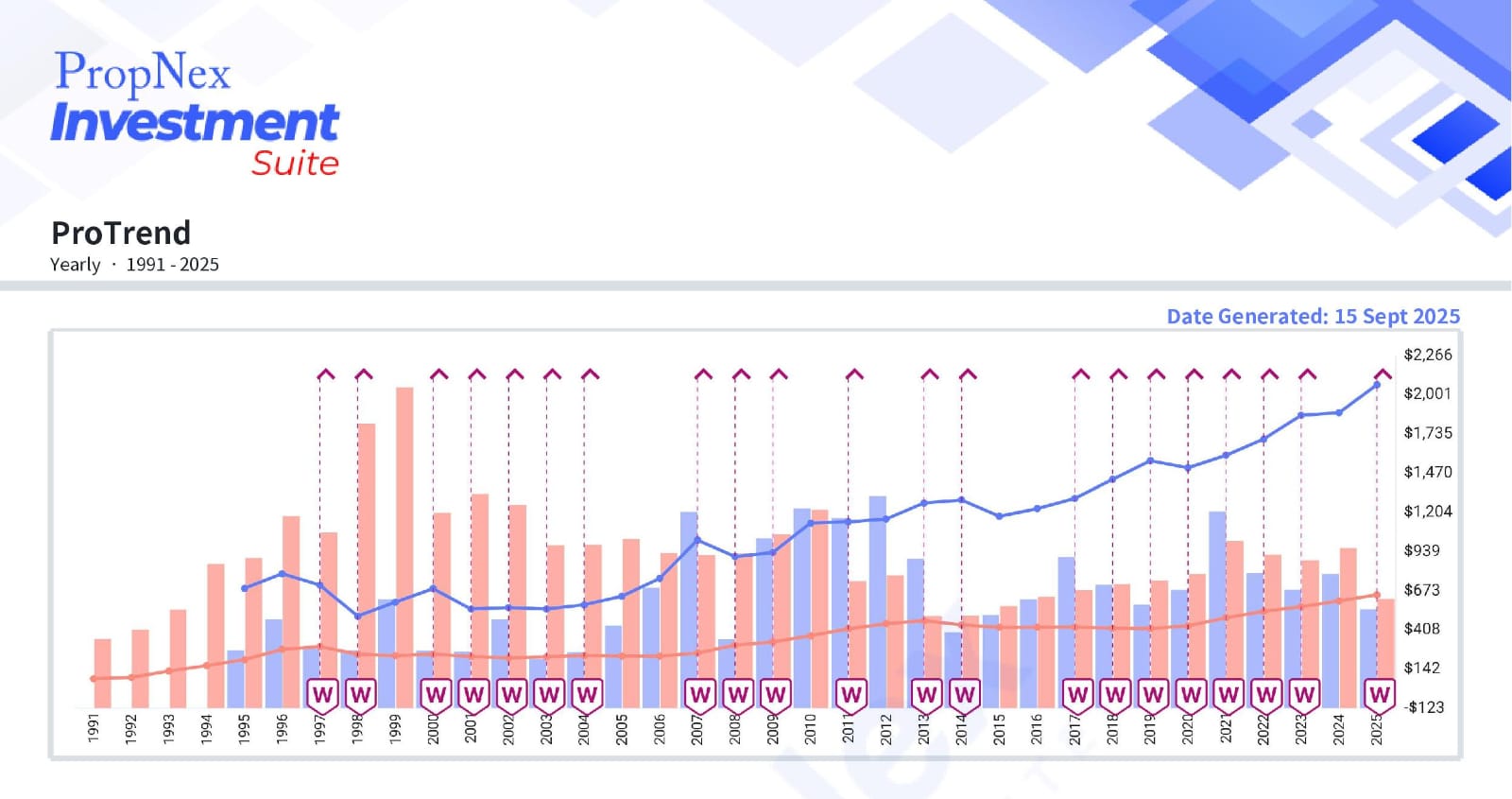

Singapore property has long been seen as a safe and appreciating asset. Strong governance, stable regulations, and resilient demand mean homes here don't just provide shelter - they build wealth. Over the decades, Singapore's housing policies and infrastructure planning have created a market that is resilient to global shocks, with public housing offering accessibility and private homes delivering consistent capital growth.

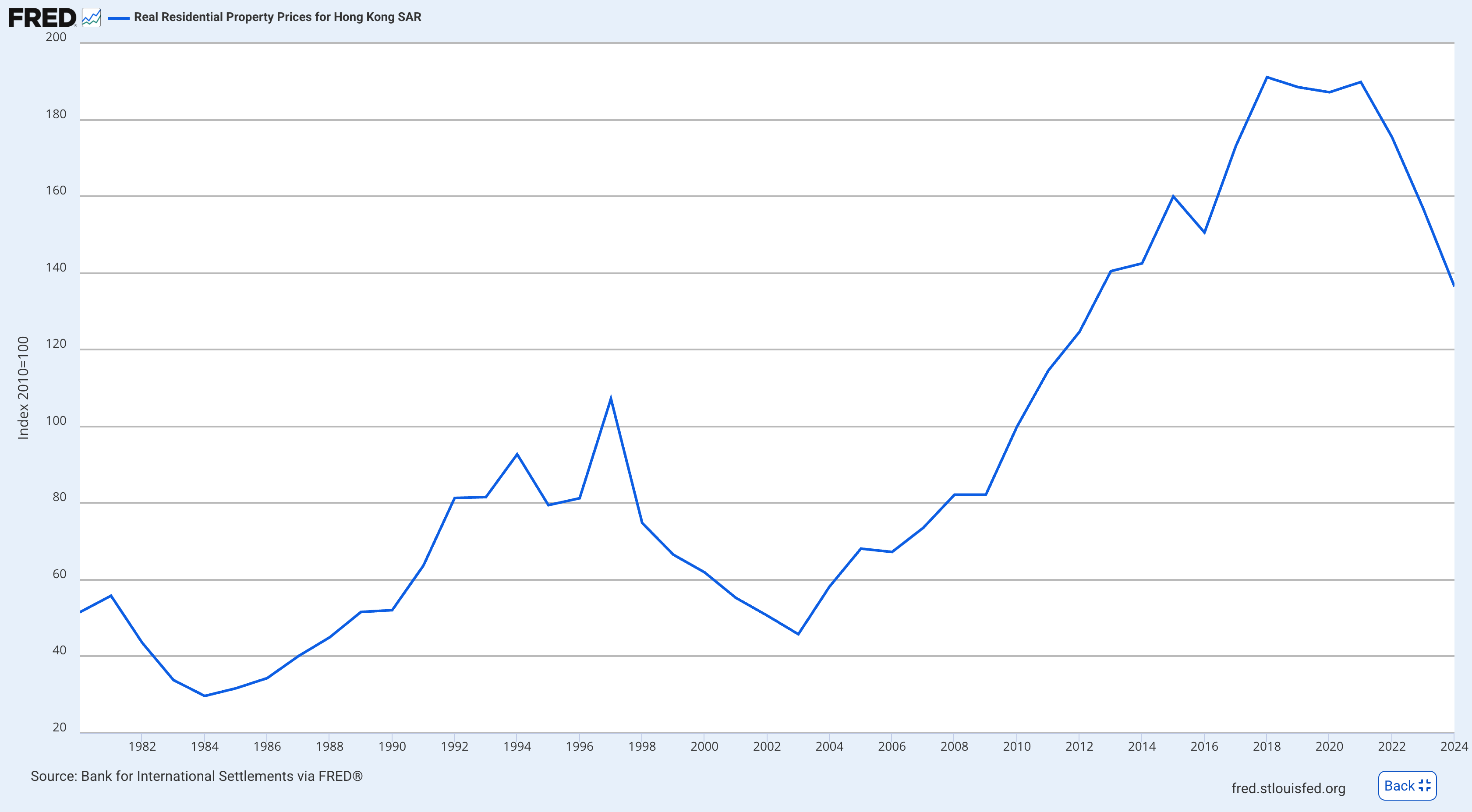

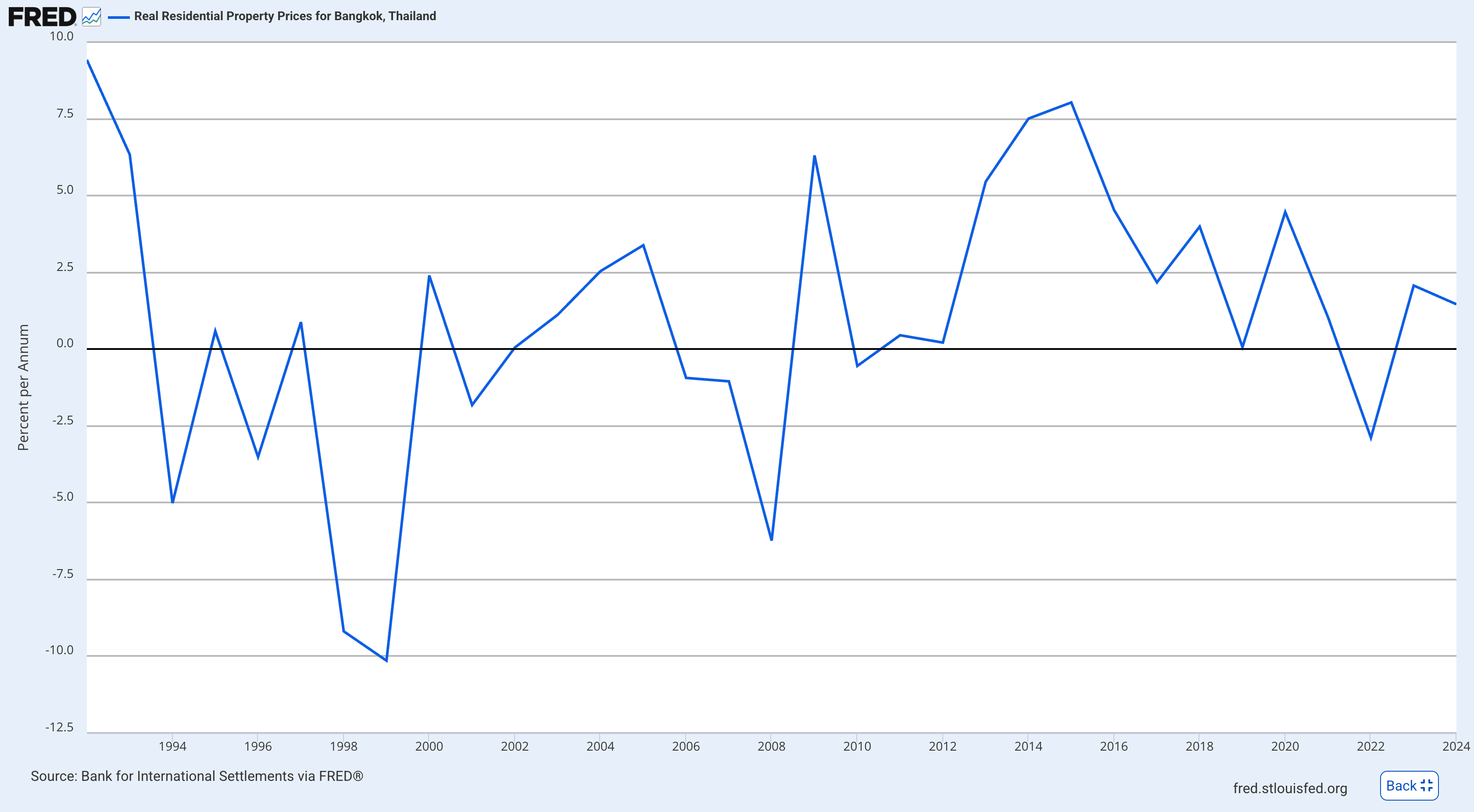

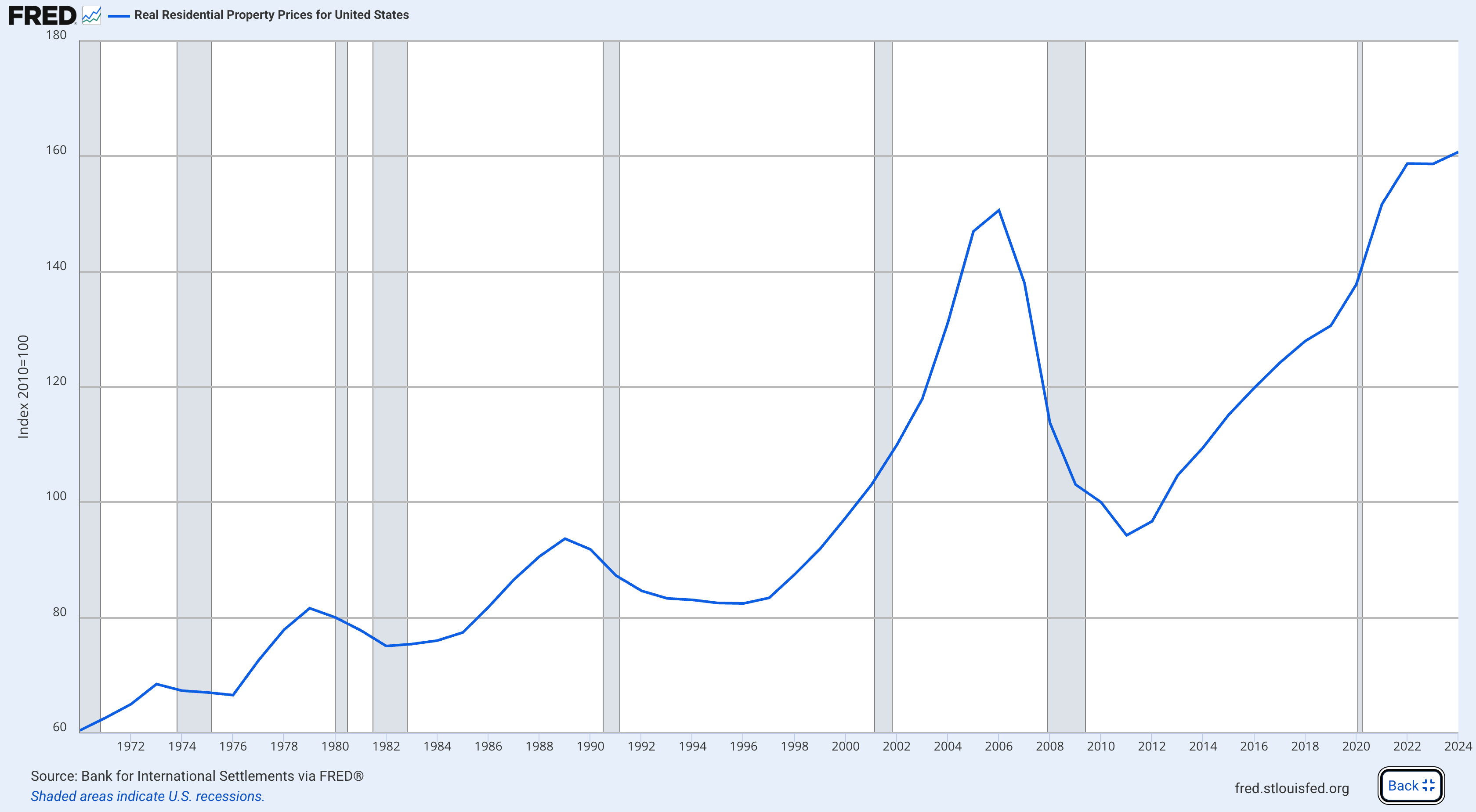

Even during global downturns such as the Asian Financial Crisis (1997), the Global Financial Crisis (2007), or the COVID-19 pandemic (2019), prices and demand in Singapore showed resilience compared to many other markets. When you line this against markets like Hong Kong, the US, and Bangkok, the contrast is clear: while those cities faced sharper volatility, deeper corrections, or prolonged stagnation, Singapore's trajectory has remained steadily upward, with only brief pauses before resuming growth.

This comparative stability demonstrates why Singapore property continues to be seen as a safe harbour for long-term value. This track record of stability reassures both homeowners and investors that value will hold in the long term. Beyond the numbers, property also provides emotional assurance. No matter where you roam, there's always a fallback - a home to return to, and a foundation that steadily grows in value over time.

Owning property can also free up resources to fund your travels. For some, renting out their unit legally provides rental income that offsets living costs abroad. For others, it's the reassurance that even if the property doesn't appreciate quickly, there is still no loss-so long as the rent comfortably covers the mortgage, maintenance, and taxes. Any remaining balance then becomes usable cashflow to support their travels or personal interests.

This way, the property functions as both a home and a financial buffer, making lifestyle choices like extended stays abroad more sustainable.

This assurance does more than just ease financial stress - it empowers lifestyle choices. Families feel comfortable taking extended trips knowing their home anchors them. Young professionals can seize overseas postings or regional assignments without worrying they're leaving financial security behind. Couples may even experiment with living in another city for a season, testing new lifestyles while still keeping their foundation in Singapore. Even retirees increasingly use this model, enjoying months abroad each year while their property back home holds its value steadily, with the potential for gradual growth over time.

In short, ownership transforms travel from a luxury into a sustainable part of life, giving Singaporeans the confidence to explore while knowing they remain financially grounded.

Savings accounts can deplete. Stocks can swing wildly. But property in Singapore has proven itself a dependable long-term asset, consistently building value over decades. Unlike cash that erodes with inflation or equities that can be unpredictable, property offers both stability and appreciation. Historical data showed earlier that despite global crises, the Singapore housing market has bounced back stronger, giving homeowners confidence that their wealth will not only be preserved but also grow.

People take risks and chase new experiences all the time, even without owning property. But owning a home helps ease the worries that often come with such decisions. Knowing you have a secure financial pillar growing steadily in the background makes it easier to explore other areas of life - whether that's travelling, trying new ventures, or living abroad for a season - without feeling like you are jeopardising your future.

If overseas property investment is on your mind, the safest place to start is right here in Singapore. Our property landscape is one of the most stable in the world - transparent regulations, steady appreciation, and a mature market. By first building a strong foundation locally, Singaporeans gain the financial security and confidence needed to explore riskier overseas markets. Once that foundation is secure, diversifying into overseas properties can bring additional benefits such as exposure to different economies, currencies, and rental markets, helping spread risk and capture opportunities beyond Singapore.

In other words, your Singapore home isn't just a place to live - it's the springboard for bigger dreams abroad, and potentially a gateway to a more diversified portfolio.

Note: Figures below are illustrations only. Always check your actual numbers (mortgage, annual value, tax rates, MCST) and local regulations.

Key assumptions (for illustration)

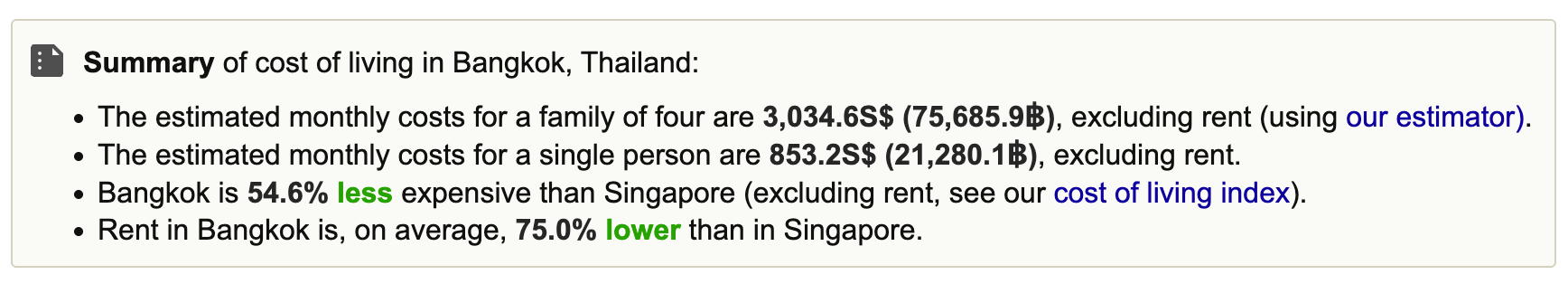

Source: https://www.numbeo.com/

Non-owner-occupied property tax is charged on annual value at progressive rates. For an annual value (AV) of $60,000 (est. $5,000/month market rent), the annual tax is $10,800 (est. $900/month).

Average private condo MCST fees: $300-$700/month depending on development and unit size.

Bangkok living: The rent of a 1-bedder apartment in the city centre is approximately $22,000 Baht; total living costs (single) $50,000-$60,000 Baht depending on lifestyle.

Scenario A - Mortgage ongoing (Tight but possible)

Item | Monthly (SGD) |

Market rent (Singapore) | $5,000 |

Mortgage repayment | $3,400 |

MCST/Maintenance | $450 |

Property tax (AV $60k = $10.8k/year) | $900 |

Landlord insurance/allowance | $100 |

Estimated monthly balance | $150 |

What this means:

Central 1-bed rent: $22,000 Baht (SGD$870)

Living costs for a single person (excluding rent): $22,000 Baht (SGD$882)

Total overseas spend (single): $1,752

Shortfall after expenditure: -$1602

With a still sizable mortgage, the numbers show a monthly surplus of just about $150 before accounting for overseas expenses. Once Bangkok rent and living costs are factored in, it actually runs a shortfall of around $1,600. This means the cashflow buffer is too thin to sustain long stays abroad on rental income alone, so the person would likely still need to work or tap other income sources.

In today's world, this is where remote or hybrid work comes in. Many Singaporeans are already embracing flexible work arrangements, which allow them to earn while living overseas. To improve outcomes: refinance if possible, review MCST tier, or consider pairing rental income with ongoing work to make the lifestyle feasible.

Scenario B - Fully paid home (Comfortable buffer)

Item | Monthly (SGD) |

Market rent (Singapore) | $5,000 |

Mortgage repayment | $0 |

MCST/Maintenance | $450 |

Property tax (AV $60k = $10.8k/year) | $900 |

Landlord insurance/allowance | $100 |

Estimated monthly balance | $3,550 |

How far can this go in Bangkok?

Central 1-bed rent: $22,000 Baht (SGD$870)

Living costs for a single person (excluding rent): $22,000 Baht (SGD$882)

Total overseas spend (single): $1,752

Surplus after expenditure: $1,798 (can fund flights, savings, or travel upgrades)

Scenario C - Right-size, then go (Retirement-friendly)

You sell a larger unit (under mortgage), fully pay for a smaller unit, then rent the smaller unit out while staying aboard.

Item | Monthly (SGD) |

Market rent (smaller unit) | $4,200 |

Mortgage repayment | $0 |

MCST/Maintenance | $350 |

Property tax (AV $50k = $7.4k/year) | $620 |

Allowance | $200 |

Estimated monthly balance | $3,030 |

What this enables:

Central 1-bed rent: $22,000 Baht (SGD$870)

Living costs for a couple (excluding rent): $38,000 Baht (SGD$1,520)

Total overseas spend (single): $2,390

Surplus after expenditure: $640 (can fund flights, savings, or travel upgrades)

Scenario D - From surplus to second home (Advanced)

If you consistently are able to save at least $1,500 monthly from rental surplus, that's at least $18,000 annually. Over 5 years, you would have built $90,000 (excluding potential investment returns), which can meaningfully fund a downpayment on an overseas property. Some buyers use right-sizing proceeds to fully pay for a modest overseas condo and then let Singapore rental income cover ongoing costs (taxes, management, travel).

Tip: Keep emergency buffers, plan for vacancy (e.g. 1 month/year), and account for currency swings when budgeting.

Compliance & practicalities:

Ensure any rental is legal and reflected in your property's annual value for tax.

Use trusted agents and/or family for key exchanges and inspections; smart locks can help with family access and security (not for short-term letting).

Revisit financing every 2-3 years to optimise rates and cashflow.

Of course, it's not without challenges. Travelling or living overseas means you may need trusted family or agents to look after your home. For those eyeing overseas purchases, there are financing hurdles, foreign ownership rules, and currency risks. And on a personal level, there's the question of balance: how do you enjoy freedom abroad while keeping your long-term goals on track?

These examples show that Singapore property can provide the buffer, but every plan still comes with responsibilities - whether it's covering vacancy, handling tax, or planning for currency swings. The good news is, you don't have to navigate it alone. Fret not - we've got you covered. Before considering any overseas property investment, check out our guide here: Don't Buy Overseas Until You Read This.

Property ownership doesn't tie you down - it sets you free. It provides the security that allows you to travel further, live abroad for a while, and pursue passions without fear. This freedom is possible precisely because Singapore's property market has proven to be one of the most stable and resilient globally, giving homeowners confidence that their wealth is well protected.

So if you're dreaming about exploring the world, remember this: the journey often begins at home. Build your roots in Singapore, strengthen them through the stability of our property landscape, and they'll give you the wings to fly.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.